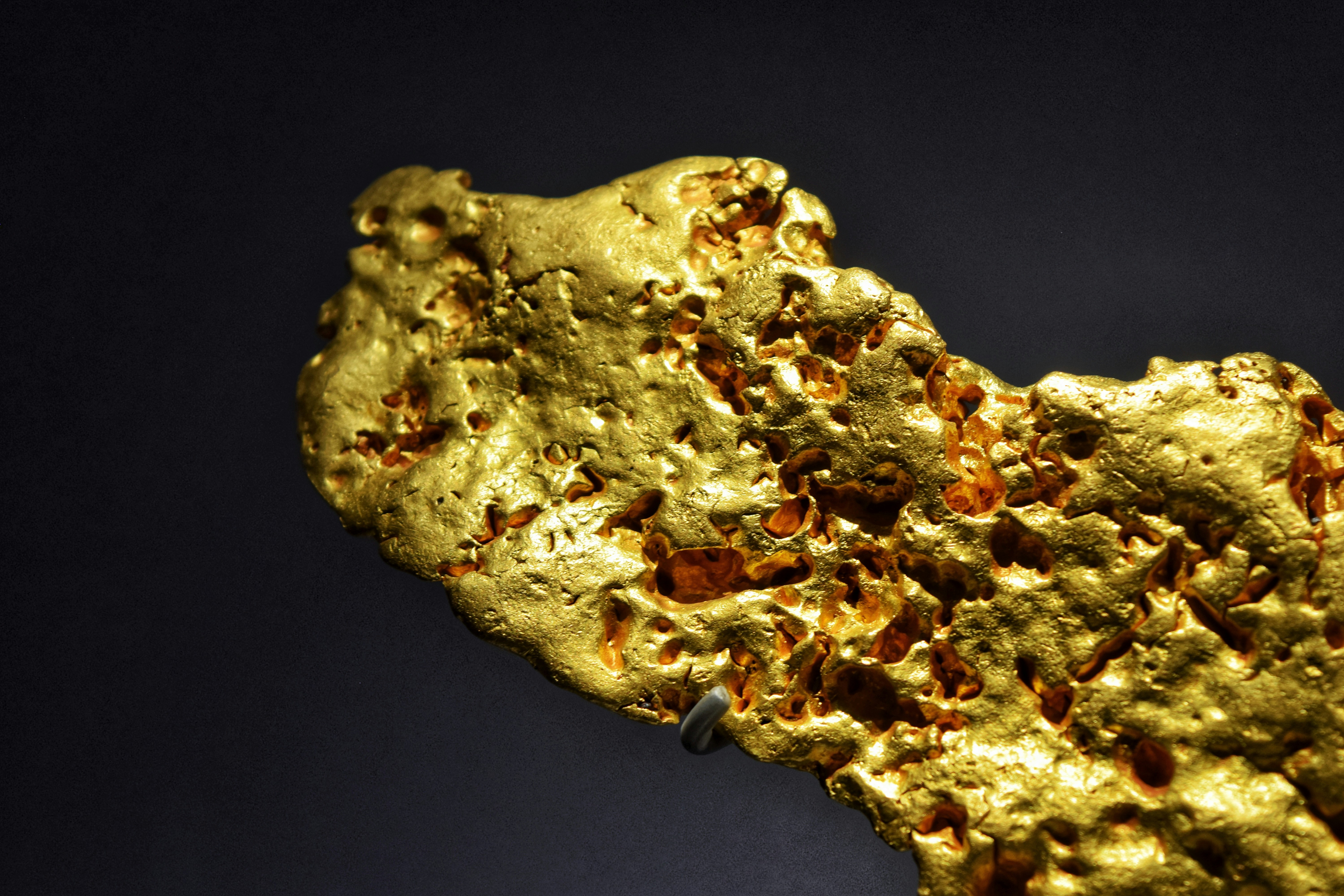

Wealth You Can Wear. Value You Can Pass On.

Gold has served as money, collateral, and status for over 5,000 years.

Today, gold offer a rare advantage:

- Portable wealth

- Globally recognized value

- Functional, wearable, and liquid

- No counterparty risk

This is not jewelry for fashion.

This is asset ownership.

Acquire Gold. For Your Future.

Silver: The Most Undervalued Hard Asset in the World

Silver demand is increasingly price-inelastic on the industrial side.

Manufacturers do not substitute away from silver easily because:

- There is no superior electrical replacement

- Silver often represents a small percentage of total system cost

- Reliability matters more than price in critical applications

As a result, higher silver prices do not destroy demand the way they do with discretionary commodities.

This creates a floor under long-term demand that speculation alone cannot explain.

Silver’s most underappreciated feature is monetary optionality.

In stable systems, silver behaves like an industrial metal.

In unstable systems, it reasserts itself as money.

This creates a convex payoff profile:

- Limited downside due to utility demand

- Explosive upside during monetary stress or currency debasement

Silver does not need to “replace” fiat currencies to reprice.

It only needs loss of confidence at the margin.

Silver markets are relatively small.

This means:

- Capital flows that barely move other asset classes can dramatically move silver

- Inventory drawdowns can trigger sharp price dislocations

- Physical shortages appear before paper markets adjust

Silver isn’t just money—it’s strategic.

It’s used in:

- Energy systems

- Electronics

- Medical technology

- Defense and infrastructure

And unlike gold, silver is consumed.

That makes physical silver bars a rare intersection of:

- Monetary metal

- Industrial necessity

- Supply pressure

When silver moves, it moves fast.

Silver occupies a rare and increasingly unstable position in the global system: it is simultaneously money, industrial infrastructure, and a strategic input—yet it is priced as if it were none of the above.

As the world transitions toward electrification, digitization, and energy decentralization, silver demand is structurally increasing while supply remains constrained, inelastic, and increasingly uneconomic to expand. This asymmetry creates conditions not for gradual appreciation, but for periodic repricing events.

Silver’s future is not driven by speculation, but by necessity.

Unlike most commodities, silver has never fully lost its monetary role. It remains:

- A historical medium of exchange

- A unit of account across civilizations

- A store of value in periods of monetary stress

Simultaneously, silver is now embedded in modern life:

- Electrical conductivity (highest of all metals)

- Solar photovoltaics

- EVs and charging infrastructure

- Medical applications

- Semiconductors and advanced electronics

Why physical metals?

Physical ownership removes counterparty risk.

Do you want your money to work for you?

- Gold has been the basis of sound money for 5,000 years.

- Silver allows for entry in monetary metals without large capital.

- We point only to providers that deliver real metal, not derivatives or gimmicks.